Economics of Inflation

From a macroeconomic perspective, inflation is typically measured by an index such as the Consumer Price Index (CPI), which measures the average change in prices of a basket of goods and services consumed by households. Inflation is often seen as a key indicator of the health of an economy, and central banks often have a target inflation rate they aim to achieve. High inflation, or hyperinflation, can have negative effects on an economy, such as reducing purchasing power and decreasing international competitiveness.

From a microeconomic perspective, inflation can have both positive and negative effects on different groups within an economy. For example, firms may benefit from inflation as they can charge higher prices for their goods and services, but consumers may be negatively affected as the cost of living increases. Similarly, people with fixed incomes, such as retirees, may be disproportionately affected by inflation as their purchasing power decreases.

Inflation can also have different effects on different sectors of the economy. For example, in the real estate market, inflation can lead to an increase in property values, which can be beneficial for homeowners, but it can also make it more difficult for buyers to afford a home. Similarly, in the labour market, inflation can lead to higher wages, which can be beneficial for workers, but it can also increase the cost of production for firms and lead to higher prices for consumers.

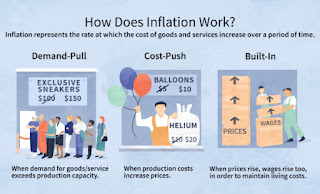

Inflation is typically caused by an increase in the money supply and a corresponding decrease in the purchasing power of money. There are several factors that can contribute to this, including:

Monetary policy: Central banks can influence inflation by controlling the money supply and interest rates. If a central bank increases the money supply and lowers interest rates, it can lead to inflation.

Cost-push factors: When the costs of goods and services increase, it can lead to higher prices for consumers. This can be caused by factors such as an increase in the cost of raw materials or labor.

Demand-pull factors: When there is high demand for goods and services, it can lead to an increase in prices. This can be caused by factors such as population growth, economic growth, and increased consumer spending.

Imported Inflation: Inflation can also be caused by an increase in the price of imported goods, for example, due to an increase in the cost of oil.

Expectations of inflation: If people expect prices to increase in the future, they may start to demand higher wages and prices today, leading to a self-fulfilling inflationary spiral.

It's important to note that inflation can be caused by a combination of these factors, and different economies may experience different types of inflation depending on which factors are primarily driving the increase in prices.

Overall, inflation can have both positive and negative effects on different groups within an economy and different sectors of the economy, and it's important to consider both macro and microeconomic perspectives when analyzing the effects of inflation.

For more resources visit www.livensuccess.ca

Comments

Post a Comment