Housing Market Collapse

In a traditional sense, a free market is one where a capable willing and well-informed buyer will pay a reasonable comparable price for a product and or services under normal conditions without pressure or duress. The only force that determines the price is supply and demand. What impacts the amount and requirements are the external factors. What others forces impact the housing market and how mixed is the whole economy and what economic indicators are to watch for when looking at the housing market? For long it was considered that the real estate market was local, is it still true?

In this blog we will test some of the narrative and the dynamic interplay of these forces and if the traditional definition of the market still fits the bill in the era of globalization? Further, does a free market really exists?

We start off by the market indicators that shape both sides of the supply and demand equation.

Real Unemployment Rate vs. Reported Unemployment Rate:

For houses to be purchased, financed and maintained, there must be a healthy job market. The average rate of unemployment since 2008 has been around 6.5% which is not counting for the rate of people who have quit looking for a job and fall off the radar. The actual unemployment rate is close to 9.5 to 10%. Therefore by this logic, the housing market in a traditional sense of the word must have experienced a slow down and stagnation except in the regions where energy development was rampant. On the contrary, the housing market has increased an average of 4.5 % increase in appreciation and volume of sales. As the latest news suggests, there will be a ripple effect of recent changes in energy, manufacturing and ultimately retail sectors will have long term implications on the demand side of the real estate market.

GDP( Gross Domestic Product) and How it Impacts the Housing Market

What is GDP? GDP stands for Gross domestic Products which calculated as following

GDP = C+I+G+ (NE), where

C = Consumption

I = Industry Investment by sector

G = Government Expenditure

NE = Net Export = ( Exports - Imports)

This indicator is an economic barometer, which measures national and global financial pressure. Any variation in this formula can impact the overall economic outlook, and if there is a reduction for three consecutive quarters the economy will be considered to be shrinking and hence a recession is triggered which has a cascading effect. Right now. Overall this indicator indicates if the economy is growing or shrinking and it impacts the business investments and has ripple effects. Hence it is a significant indicator to watch out when looking at the overall economy and in particular housing market. The developing countries like Brazil, Russia, India, China have been expressing Growth in the range of 5 to 7 percent during the economic meltdown, whereas North America and Europe were hovering around 1.5 to 2.5 since 2008. When looking at the correlation between the housing market and GDP, there is an inverse relationship. Meaning that as the GDP was stagnant or flat the housing market was still positively trending. This seems to defy the basics fundamentals of Economics.

Consumer Price Index

It is another indicator which shows basically the psychology of consumer if the consumer feels strongly about their future jobs and certainty in the investment, it will perpetuate the spending and enhance the velocity of money, meaning for every dollar the consumer spends there are 3 to 4 ratio of spin-offs and tax revenues. It is also a function of the purchasing power based on inflation i.e., the purchasing power.

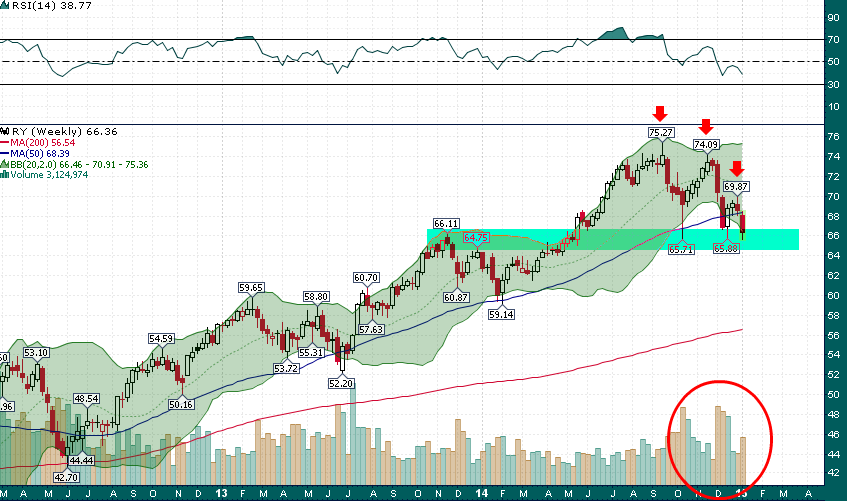

Cost of Borrowing ( interest rate)

The interest rate is a function of the rate of inflation and is determined based on the activity in the bond market. Further, it is tightly regulated based on the GDP forecast. Since each dollar in debt ironically supports 3 to 4 dollar of growth, encouraging borrowing to create spin-off economic activities. The interest rate directly impacts the housing market. In a classic free market system, the supply and demand visa via bond market and the lending market should regulate its interest rate with an equilibrium. However recently the interest rate has been used as a monetary tool for government regulators to encourage spending and increase revenues. Therefore the fundamental economics of a free market has been rendered obsolete by intervention and manipulation. This in return has created an invisible bubble and disproportionate hedging in the financial sector and has exposed the market to unrepresented pressures and risks. Hence any minor fluctuation in interest rate could trigger a market correction of up to 40% in some market.

Key Industry Indices

Canada is a sizeable stratified economy, it still depends heavily on regional industry sectors and it even a natural resource economy meaning it depends on selling off its natural resources to support economic growth. Any setback or change in any local natural resources energy will impact the local and ultimately the national housing market. For example when in the 1990s the eastern provinces were challenged due to depletion of fish stock the entire region was negatively impacted because of adjustment in that industry. When the US economy slows down Quebec's and Ontario's manufacturing sectors is affected negatively, and when there is Energy Sector adjustment, there will be an adjustment in the energy-producing provinces in the Atlantic, Alberta, and Saskatchewan. Therefore any slow down in any industry will impact the real estate market. With the price of oil dropping, this can have a real adverse impact on the housing market across the country.

Geopolitical Realities

With the fluid international market structure and disconnectedness, more an more we are impacted with what is happening on the other side of the world. We are currently are witnessing of the wealth relocation of epic proportion in the history of the world. With some conflicts on the rise and the uncertainty of enormous balance since the end of WWII and the cold war, and with the production of wealth in the developing countries more and more investors are looking for a saver shore to anchor their ships, and the Canadian housing market is one such place. On an estimated basis 60 % of development mainly in the condo market of Vancouver, Toronto is fueled by foreign investors and business immigrant. This action has forced the government to scrap its old business immigration visa has the influx of the buyers have fueled the overheated bubble of the housing market. Compounded with ultra-low interest rates. There is a direct relationship between some ongoing hot conflicts and the amount of money deposited in the banking system from overseas, mainly from conflict zones.

This allows the capital markets to function and makes war as an official economic policy for most of the western countries. What it does? It squeezes the middle class from the housing market and raises the benchmark for home ownership.

Other Factors

Cost of Living Factor and Break Even Point.

For average Canadian, the average income for break-even point based on two people working is about $74,000 to make ends meet. With average mortgage amount approaching half a million in some regions and not having won the National Lottery affording or even qualifying for a mortgage is impossible. Hence pushes the middle class from a net benefit of home ownership, thus creates a more significant gap between rich and poor.

Therefore

Growth in the housing sector is non-organic and is not sustainable due to the factors discussed above. Further, a free market does no longer exist and all the indicators suggest that if the governments stop controlling the lending policies of the banks the natural correction will require a prolonged contraction in the market that could last the duration of a typical real estate cycle which used to be 7-10 to 15 to 25 years. This will be the most prolonged correction in history. As a result, there will cause a colossal collapse and merger of several lending institutions and loss of unreleased asset loss in the order of 1.5 Trillion Dollars. Further since the real estate market is closely impacted by bonds markets and inherently bonds and stocks are interrelated, and by that, deflation will occur that will start with suppression of commodity and energy prices further it will destabilize other sectors of the economy. Therefore my prediction is that there is 10% of real-world economic collapse. Asset allocation and re-grouping our thinking in terms of really how we define wealth and how do we redefine investment and investment moralities. To conclude real estate is over leverage like most other asset class and we must only limit 1/4 of our risks in this overvalued asset class.

In this blog we will test some of the narrative and the dynamic interplay of these forces and if the traditional definition of the market still fits the bill in the era of globalization? Further, does a free market really exists?

We start off by the market indicators that shape both sides of the supply and demand equation.

Real Unemployment Rate vs. Reported Unemployment Rate:

For houses to be purchased, financed and maintained, there must be a healthy job market. The average rate of unemployment since 2008 has been around 6.5% which is not counting for the rate of people who have quit looking for a job and fall off the radar. The actual unemployment rate is close to 9.5 to 10%. Therefore by this logic, the housing market in a traditional sense of the word must have experienced a slow down and stagnation except in the regions where energy development was rampant. On the contrary, the housing market has increased an average of 4.5 % increase in appreciation and volume of sales. As the latest news suggests, there will be a ripple effect of recent changes in energy, manufacturing and ultimately retail sectors will have long term implications on the demand side of the real estate market.

GDP( Gross Domestic Product) and How it Impacts the Housing Market

What is GDP? GDP stands for Gross domestic Products which calculated as following

GDP = C+I+G+ (NE), where

C = Consumption

I = Industry Investment by sector

G = Government Expenditure

NE = Net Export = ( Exports - Imports)

This indicator is an economic barometer, which measures national and global financial pressure. Any variation in this formula can impact the overall economic outlook, and if there is a reduction for three consecutive quarters the economy will be considered to be shrinking and hence a recession is triggered which has a cascading effect. Right now. Overall this indicator indicates if the economy is growing or shrinking and it impacts the business investments and has ripple effects. Hence it is a significant indicator to watch out when looking at the overall economy and in particular housing market. The developing countries like Brazil, Russia, India, China have been expressing Growth in the range of 5 to 7 percent during the economic meltdown, whereas North America and Europe were hovering around 1.5 to 2.5 since 2008. When looking at the correlation between the housing market and GDP, there is an inverse relationship. Meaning that as the GDP was stagnant or flat the housing market was still positively trending. This seems to defy the basics fundamentals of Economics.

Consumer Price Index

It is another indicator which shows basically the psychology of consumer if the consumer feels strongly about their future jobs and certainty in the investment, it will perpetuate the spending and enhance the velocity of money, meaning for every dollar the consumer spends there are 3 to 4 ratio of spin-offs and tax revenues. It is also a function of the purchasing power based on inflation i.e., the purchasing power.

Cost of Borrowing ( interest rate)

The interest rate is a function of the rate of inflation and is determined based on the activity in the bond market. Further, it is tightly regulated based on the GDP forecast. Since each dollar in debt ironically supports 3 to 4 dollar of growth, encouraging borrowing to create spin-off economic activities. The interest rate directly impacts the housing market. In a classic free market system, the supply and demand visa via bond market and the lending market should regulate its interest rate with an equilibrium. However recently the interest rate has been used as a monetary tool for government regulators to encourage spending and increase revenues. Therefore the fundamental economics of a free market has been rendered obsolete by intervention and manipulation. This in return has created an invisible bubble and disproportionate hedging in the financial sector and has exposed the market to unrepresented pressures and risks. Hence any minor fluctuation in interest rate could trigger a market correction of up to 40% in some market.

Key Industry Indices

Canada is a sizeable stratified economy, it still depends heavily on regional industry sectors and it even a natural resource economy meaning it depends on selling off its natural resources to support economic growth. Any setback or change in any local natural resources energy will impact the local and ultimately the national housing market. For example when in the 1990s the eastern provinces were challenged due to depletion of fish stock the entire region was negatively impacted because of adjustment in that industry. When the US economy slows down Quebec's and Ontario's manufacturing sectors is affected negatively, and when there is Energy Sector adjustment, there will be an adjustment in the energy-producing provinces in the Atlantic, Alberta, and Saskatchewan. Therefore any slow down in any industry will impact the real estate market. With the price of oil dropping, this can have a real adverse impact on the housing market across the country.

Geopolitical Realities

With the fluid international market structure and disconnectedness, more an more we are impacted with what is happening on the other side of the world. We are currently are witnessing of the wealth relocation of epic proportion in the history of the world. With some conflicts on the rise and the uncertainty of enormous balance since the end of WWII and the cold war, and with the production of wealth in the developing countries more and more investors are looking for a saver shore to anchor their ships, and the Canadian housing market is one such place. On an estimated basis 60 % of development mainly in the condo market of Vancouver, Toronto is fueled by foreign investors and business immigrant. This action has forced the government to scrap its old business immigration visa has the influx of the buyers have fueled the overheated bubble of the housing market. Compounded with ultra-low interest rates. There is a direct relationship between some ongoing hot conflicts and the amount of money deposited in the banking system from overseas, mainly from conflict zones.

This allows the capital markets to function and makes war as an official economic policy for most of the western countries. What it does? It squeezes the middle class from the housing market and raises the benchmark for home ownership.

Other Factors

Cost of Living Factor and Break Even Point.

For average Canadian, the average income for break-even point based on two people working is about $74,000 to make ends meet. With average mortgage amount approaching half a million in some regions and not having won the National Lottery affording or even qualifying for a mortgage is impossible. Hence pushes the middle class from a net benefit of home ownership, thus creates a more significant gap between rich and poor.

Therefore

Growth in the housing sector is non-organic and is not sustainable due to the factors discussed above. Further, a free market does no longer exist and all the indicators suggest that if the governments stop controlling the lending policies of the banks the natural correction will require a prolonged contraction in the market that could last the duration of a typical real estate cycle which used to be 7-10 to 15 to 25 years. This will be the most prolonged correction in history. As a result, there will cause a colossal collapse and merger of several lending institutions and loss of unreleased asset loss in the order of 1.5 Trillion Dollars. Further since the real estate market is closely impacted by bonds markets and inherently bonds and stocks are interrelated, and by that, deflation will occur that will start with suppression of commodity and energy prices further it will destabilize other sectors of the economy. Therefore my prediction is that there is 10% of real-world economic collapse. Asset allocation and re-grouping our thinking in terms of really how we define wealth and how do we redefine investment and investment moralities. To conclude real estate is over leverage like most other asset class and we must only limit 1/4 of our risks in this overvalued asset class.

Comments

Post a Comment